The banner is to inform the visitors of an important message.

Solutions

In the digital age, the ability to conduct transactions online is a fundamental aspect of running a successful business. At the heart of these online transactions are systems known as payment gateways. These digital platforms act as intermediaries, facilitating the transfer of information between a payment portal (like a website or a mobile app) and the bank or card issuer.

Choosing the right payment gateway is a critical decision for any business, but it's particularly important for Australian businesses. The right gateway can streamline your operations, improve customer satisfaction, and even boost your bottom line. Conversely, a poor choice can lead to transaction errors, security issues, and a frustrating customer experience.

In this article, we'll delve into the world of payment gateways, exploring their role, their importance, and how to choose the right one for your Australian business. Whether you're a small start-up or a large corporation, understanding payment gateways is key to your online success. So, let's dive in and explore the best payment gateways for Australian businesses.

Australia's digital economy is thriving, and with it comes a variety of payment gateways that businesses can choose from. Some of the top players in the Australian market include PayPal, Stripe, Square, eWay, and SecurePay. Each of these payment gateways offers a unique set of features, and understanding these can help businesses choose the one that best fits their needs.

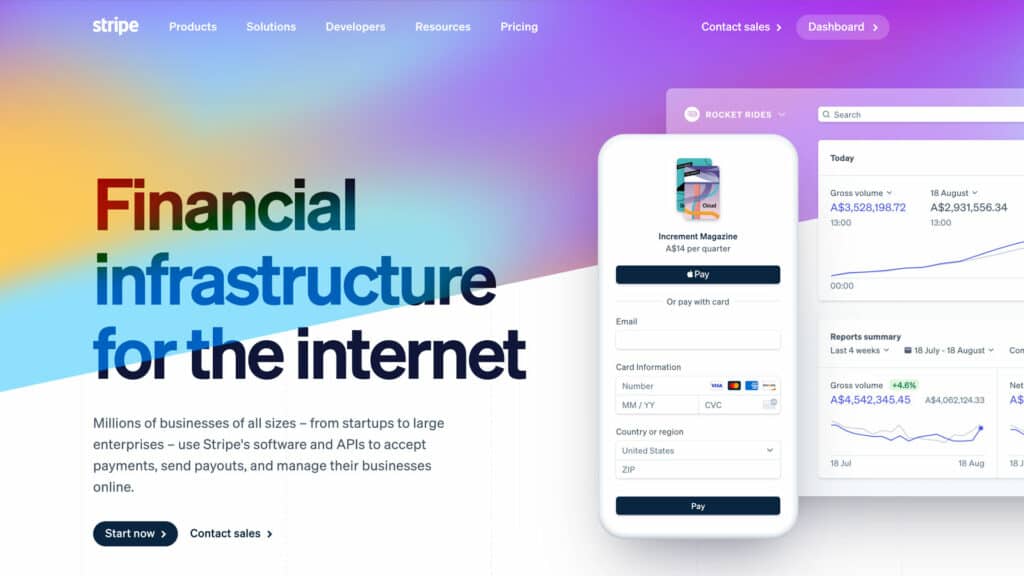

Stripe is a powerful and flexible payment gateway that's designed for internet commerce. It provides businesses with the tools they need to create a seamless payment experience for their customers.

Businesses can integrate Stripe into their online store or app. When a customer makes a purchase, Stripe processes the transaction, encrypts the customer's payment information, and sends the funds to the business's bank account.

Stripe charges a fee per transaction, with no setup or monthly fees. However, fees can vary, so it's always a good idea to check the most current rates on the Stripe website.

Stripe's unique features include its powerful API, which allows businesses to customize their payment experience, and its range of additional services, such as Stripe Atlas, which helps internet businesses get started, and Stripe Radar, which provides advanced fraud protection.

Stripe can be integrated with a wide range of e-commerce platforms, including Shopify, WooCommerce, and Magento. It also offers a robust API for custom integrations.

Stripe's flexibility, powerful features, and competitive pricing make it a strong choice for Australian businesses of all sizes. It's a particularly good option for businesses that want to customize their payment experience or that need advanced features like subscription billing or marketplace payments.

Compared to other payment gateways, Stripe stands out for its powerful API and range of additional services. However, its transaction fees may be higher than some other options, so businesses should consider their specific needs and budget.

PayPal is one of the most widely recognised and used payment gateways in the world. It provides a secure and convenient way for businesses to accept payments online, with the added benefit of its large user base.

Businesses can integrate PayPal into their online store or app. When a customer makes a purchase, they can choose to pay with their PayPal account or a credit or debit card. PayPal processes the transaction and deposits the funds into the business's PayPal account.

PayPal charges a fee per transaction, with no setup or monthly fees. However, fees can vary, so it's always a good idea to check the most current rates on the PayPal website.

PayPal's unique features include its large user base, which can help increase conversion rates, and its One Touch checkout, which allows customers to pay without entering their login or payment information.

PayPal can be integrated with a wide range of e-commerce platforms, including Shopify, WooCommerce, and Magento. It also offers a robust API for custom integrations.

PayPal's wide recognition and user base make it a strong choice for Australian businesses, especially those that sell to consumers. Its One Touch checkout can also provide a better shopping experience for customers.

Compared to other payment gateways, PayPal stands out for its large user base and One Touch checkout. However, its transaction fees may be higher than some other options, so businesses should consider their specific needs and budget.

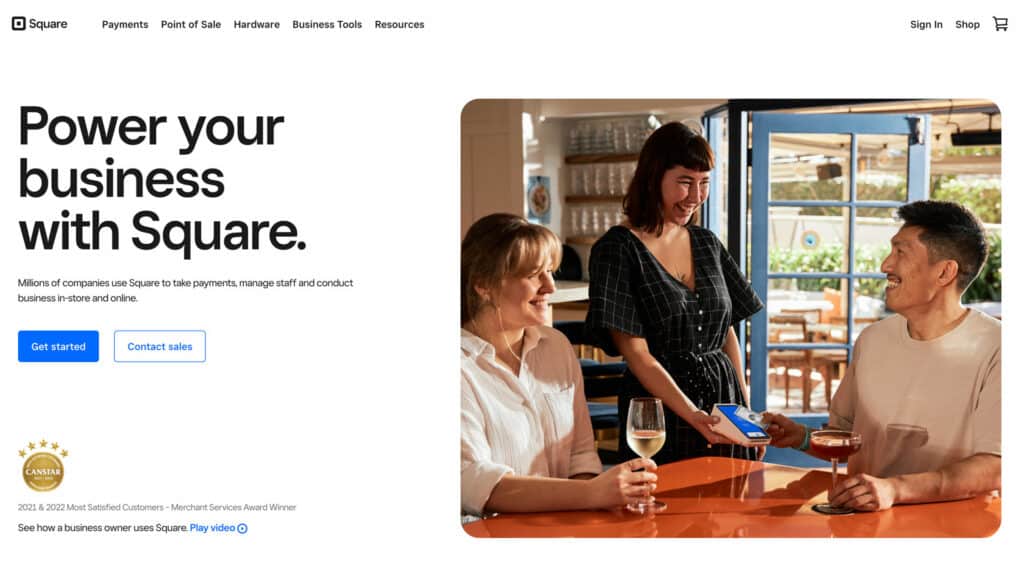

Square is a versatile payment gateway known for its point-of-sale (POS) systems and mobile payment solutions. It offers a range of products that cater to businesses of all sizes, from small retailers to large enterprises.

Businesses can integrate Square into their online store, physical store, or both. Square provides hardware for in-person payments and software for online payments. When a customer makes a purchase, Square processes the transaction and deposits the funds into the business's bank account.

Square charges different rates for online, in-person, and invoice payments. There are no setup or monthly fees. However, fees can vary, so it's always a good idea to check the most current rates on the Square website.

Square's unique features include its POS systems, which allow businesses to accept in-person payments, and its free online store platform, which enables businesses to sell online easily. Square also offers inventory management tools and customer relationship management (CRM) features.

Square can be integrated with a variety of e-commerce platforms, including Shopify, WooCommerce, and Magento. It also offers a robust API for custom integrations.

Square's versatility and comprehensive features make it a strong choice for Australian businesses, especially those that operate both online and offline. Its free online store platform can be particularly beneficial for small businesses or startups.

Compared to other payment gateways, Square stands out for its POS systems and free online store platform. However, its transaction fees may be higher than some other options, so businesses should consider their specific needs and budget.

Shopify Payments is the integrated payment gateway for Shopify, one of the most popular e-commerce platforms. It provides a seamless checkout experience for customers and simplifies the payment process for businesses.

Businesses using Shopify can enable Shopify Payments to accept credit card payments directly on their store. When a customer makes a purchase, Shopify Payments processes the transaction and deposits the funds into the business's bank account.

Shopify Payments charges a fee per transaction, with the rate depending on the business's Shopify plan. There are no setup or monthly fees specifically for Shopify Payments, but the overall Shopify plan does have a monthly cost. Fees can vary, so it's always a good idea to check the most current rates on the Shopify website.

Shopify Payments' unique features include its seamless integration with the Shopify platform, which can help improve conversion rates, and its fraud analysis features, which help protect businesses from fraudulent transactions.

As an integrated part of Shopify, Shopify Payments is designed to work seamlessly with the Shopify platform. It does not integrate directly with other e-commerce platforms.

For Australian businesses that use Shopify, Shopify Payments provides a seamless and convenient way to accept payments. Its fraud analysis features can also provide added security.

Compared to other payment gateways, Shopify Payments stands out for its seamless integration with Shopify and its fraud analysis features. However, it's only an option for businesses that use Shopify, and its transaction fees may be higher than some other options, depending on the business's Shopify plan.

Eway is a leading payment gateway in Australia, providing a fast, simple, and secure way for businesses to accept payments online. It's known for its advanced fraud prevention, fast settlement times, and 24/7 Australian-based support.

Businesses can integrate Eway into their online checkout process. Once integrated, customers can choose to pay via Eway at checkout. Eway processes the payment and sends the funds to the business's bank account.

Eway charges a small fee per transaction, with no setup or monthly fees. However, fees can vary, so it's always a good idea to check the most current rates on the Eway website.

Eway's standout features include advanced fraud prevention, fast settlement times, and 24/7 Australian-based support. Eway also offers a range of integration options, allowing businesses to integrate Eway with their existing systems and processes.

Eway can be integrated with a wide range of e-commerce platforms, including Shopify, WooCommerce, and Magento. It also offers a robust API for custom integrations.

Eway's robust features, competitive pricing, and Australian-based support make it a strong choice for Australian businesses. However, businesses that need to accept international payments may need to consider other options, as Eway primarily focuses on the Australian market.

Compared to other payment gateways, Eway stands out for its advanced fraud prevention and fast settlement times. However, it may not be the best choice for businesses that need to accept a wide range of international payments.

SecurePay, a business of Australia Post, is a premium online payment gateway for Australian businesses. It offers a secure and reliable platform for processing payments, with a focus on simplicity and ease of use.

Businesses can integrate SecurePay into their online store or app. When a customer makes a purchase, SecurePay securely processes the transaction, encrypts the customer's payment information, and sends the funds to the business's bank account.

SecurePay charges a fee per transaction, with different pricing plans available based on business needs. However, fees can vary, so it's always a good idea to check the most current rates on the SecurePay website.

SecurePay offers a range of features designed to make online payments easy. These include advanced fraud prevention tools, the ability to accept payments from international customers, and the backing of Australia Post, a trusted name in Australian business.

SecurePay can be integrated with a wide range of e-commerce platforms, including Shopify, WooCommerce, and Magento. It also offers a robust API for custom integrations.

SecurePay's robust features, competitive pricing, and the backing of Australia Post make it a strong choice for Australian businesses. It's a particularly good option for businesses that need to accept international payments.

Compared to other payment gateways, SecurePay stands out for its advanced fraud prevention tools and the backing of Australia Post. However, its fees may be higher than some other options, so it's important for businesses to consider their specific needs and budget.

WorldPay is a global leader in payment processing that provides comprehensive payment solutions for businesses of all sizes. It offers a wide range of payment options, including credit and debit cards, mobile payments, and international payments.

Businesses can integrate WorldPay into their online store or app. When a customer makes a purchase, WorldPay processes the transaction, encrypts the customer's payment information, and sends the funds to the business's bank account.

WorldPay's pricing structure can vary based on the specific services used and the volume of transactions processed. It's always a good idea to check the most current rates on the WorldPay website.

WorldPay's unique features include its wide range of payment options, advanced fraud protection tools, and global reach. It also offers detailed analytics and reporting tools to help businesses track and improve their performance.

WorldPay can be integrated with a wide range of e-commerce platforms, including Shopify, WooCommerce, and Magento. It also offers a robust API for custom integrations.

WorldPay's comprehensive features and global reach make it a strong choice for Australian businesses that operate internationally. Its wide range of payment options can also provide a better shopping experience for customers.

Compared to other payment gateways, WorldPay stands out for its wide range of payment options and global reach. However, its pricing structure can be more complex than some other options, so businesses should consider their specific needs and budget.

Pin Payments is an Australian-based payment gateway that allows businesses to accept payments from customers around the world, in multiple currencies, without the need for a merchant account.

Businesses can integrate Pin Payments into their online store or app. When a customer makes a purchase, Pin Payments processes the transaction, encrypts the customer's payment information, and sends the funds to the business's bank account.

Pin Payments charges a fee per transaction, with no setup or monthly fees. However, fees can vary, so it's always a good idea to check the most current rates on the Pin Payments website.

Pin Payments' unique features include its ability to accept payments in multiple currencies and its no-merchant-account-required setup, which can make it easier for small businesses to start accepting online payments.

Pin Payments can be integrated with a variety of e-commerce platforms, including Shopify, WooCommerce, and Magento. It also offers a robust API for custom integrations.

Pin Payments' easy setup and multi-currency support make it a strong choice for Australian businesses, especially small businesses and startups that want to start accepting online payments quickly and easily.

Compared to other payment gateways, Pin Payments stands out for its no-merchant-account-required setup and multi-currency support. However, its transaction fees may be higher than some other options, so businesses should consider their specific needs and budget.

ANZ eGate is a secure and reliable payment gateway offered by ANZ, one of Australia's leading banks. It provides businesses with a simple and secure way to accept online credit card payments.

Businesses can integrate ANZ eGate into their online store or app. When a customer makes a purchase, ANZ eGate processes the transaction, encrypts the customer's payment information, and sends the funds to the business's ANZ account.

ANZ eGate charges a fee per transaction, with additional fees for setup and monthly usage. However, fees can vary, so it's always a good idea to check the most current rates on the ANZ website.

ANZ eGate's unique features include its robust security measures, which are backed by ANZ's reputation as a leading bank. It also offers real-time transaction processing and detailed reporting tools.

ANZ eGate can be integrated with a variety of e-commerce platforms, including Shopify, WooCommerce, and Magento. It also offers a robust API for custom integrations.

ANZ eGate's robust security, real-time processing, and detailed reporting make it a strong choice for Australian businesses, especially those that already bank with ANZ.

Compared to other payment gateways, ANZ eGate stands out for its robust security and real-time processing. However, its fees may be higher than some other options, so businesses should consider their specific needs and budget.

2Checkout is a global payment gateway that allows businesses to accept online and mobile payments from buyers worldwide, with localised payment options. It offers a range of features designed to help businesses maximise their online sales.

Businesses can integrate 2Checkout into their online store or app. When a customer makes a purchase, 2Checkout processes the transaction, encrypts the customer's payment information, and sends the funds to the business's bank account.

2Checkout charges a fee per transaction, with different pricing plans available based on the specific services used and the volume of sales. However, fees can vary, so it's always a good idea to check the most current rates on the 2Checkout website.

2Checkout's unique features include its global reach, with support for multiple payment methods and currencies, and its advanced fraud protection. It also offers a range of marketing tools, such as cart abandonment recovery and up-selling capabilities.

2Checkout can be integrated with a wide range of e-commerce platforms, including Shopify, WooCommerce, and Magento. It also offers a robust API for custom integrations.

2Checkout's global reach and advanced features make it a strong choice for Australian businesses that operate internationally. Its wide range of payment options can also provide a better shopping experience for customers.

Compared to other payment gateways, 2Checkout stands out for its global reach and advanced marketing tools. However, its transaction fees may be higher than some other options, so businesses should consider their specific needs and budget.

At its core, a payment gateway is a technology that acts as a conduit between an e-commerce website (or over-the-phone business) and the bank that authorises (or declines) a customer's credit card payment. The payment gateway performs a variety of tasks to process the transaction.

When a customer places an order from an online store, the payment gateway performs a series of tasks to finalize the transaction:

This entire process happens in a matter of seconds!

Security is a paramount concern when dealing with financial transactions. Payment gateways utilize a variety of security measures to ensure the safe handling of sensitive information, such as credit card numbers, ensuring they are passed securely from the customer to the merchant, then from the merchant to the payment processor.

Key security measures used by payment gateways include encryption, where sensitive information is scrambled during transmission, and tokenisation, where sensitive data is replaced with unique identification symbols that retain all the essential information without compromising its security. Payment gateways also comply with the Payment Card Industry Data Security Standard (PCI DSS), which sets the standard for secure transactions.

Payment gateways play a significant role in the customer experience in online shopping. A smooth, secure, and efficient checkout process can significantly enhance the customer experience, leading to higher customer satisfaction and increased likelihood of repeat purchases.

Payment gateways also offer customers the flexibility to pay using their preferred payment method, be it credit card, debit card, or digital wallets. Some payment gateways even offer additional features like saved card details for faster checkout on future purchases, further enhancing the customer experience.

Choosing the right payment gateway is a crucial decision for any online business. The payment gateway you choose can significantly impact your customers' experience, your business's operations, and your bottom line. Here are some key factors to consider when making your choice:

Every business is unique, and what works well for one business may not work as well for another. When choosing a payment gateway, it's important to consider your business's specific needs. For example, if you sell internationally, you might need a payment gateway that supports multiple currencies. If you sell subscription-based products, you might need a payment gateway that supports recurring payments.

Choosing the right payment gateway is not a decision to be taken lightly. It requires a clear understanding of your business needs, careful comparison of different options, and thoughtful consideration of your customers' preferences and expectations. By doing so, you can ensure a smooth and secure payment process, leading to higher customer satisfaction and ultimately, business success.

Remember, the best payment gateway for your business is the one that fits your unique needs and provides the best experience for your customers. So, take your time, do your research, and make the choice that's right for you.